As the global hurricane and typhoon season begins, a critically important gathering of the World Economic Forum on East Africa has just concluded in Manila, with nearly every session expounding on the tragic consequences and lessons learned from last year's Typhoon Haiyan.

Decision makers from the private, financial, and public and development communities committed to instilling more resilient measures in responding to and handling disasters. They expect to shape regional and industry agendas by addressing Association of Southeast Asian Nations, or ASEAN, opportunities for mitigating resource risks and vulnerabilities tied to climate change.

Among other issues, participants found common ground on such areas as climate smart growth, decision-making in a disruptive world, green and climate-resilient investments that encompass public-private resiliency funds for disaster-prone areas, solutions for climate and resource risks and enhancements of risk awareness and management.

In deliberating, participants considered some of the learnings from Hurricane Katrina, the devastating disaster that struck the Gulf region of the United States nine years ago this August. Its impact on the southeast region persists.

For one specific company, New Orleans' electric utility Entergy Corp., the hurricane caused an estimated $750 million and $1.1 billion in damages, according to an Entergy U.S. Senate testimony. It also galvanized the integrated energy company to transform itself into a true climate-resiliency leader.

Fortunately, the utility possessed a well-rehearsed emergency-response plan that included safety performance drills, a disaster-recovery plan, communications continuity using satellite phones during repairs, and swift internal infrastructure restoration. A learning organization, Entergy adopted lessons from Katrina and responded proactively to Hurricane Rita the very next month. It shut down various operations and reduced staff to keep more employees out of harm's way.

Entergy, of course, serves the Gulf region and can't just get up and move. Since Katrina and Rita, it has invested in wetlands restoration and other community assets to shore up resiliency. As for community resiliency, Entergy ensures a consistent supply of power.

An Example for Others

Entergy's story offers a great example to companies worldwide at risk from coastal storms. What does that risk look like?

In its latest stark report, the Intergovernmental Panel on Climate Change describes significant and worsening environmental risks to the world's poorer countries. And with rising seas, increasing storm intensity and population shifts to cities at the shore, the future promises to be truly tough for millions upon millions of people worldwide.

By increasing risks to human health, welfare, and ecosystems, climate impacts can threaten primary development goals -- reducing poverty, increasing access to education, improving child health, combating disease and managing natural resources sustainably.

The coastal areas, of course, are on the front lines. As tropical cyclone season arrives (and keeps us riveted to the news, worried about frequent tragedies) and continues through November, one startling fact relays their impact. Since 2005, in Southeast Asia alone, more than 172,500 people have lost their lives to tropical cyclones, and economic losses from them exceed more than $122 billion (in 2014 dollars), according to data from Aon Benfield Impact Forecasting.

Southeast Asia at Particular Risk

Of course, the ASEAN region is at particular risk since a disproportionate percentage of the population lives within five meters of sea level, according to the Center for International Earth Science Information Network, or CIESIN. With the exception of Laos, ASEAN countries possess more coastal area -- the percent of land less than 10 meters above sea level -- than 80 percent of the rest of the world's countries. And, again with the exception of Laos, ASEAN countries have more coastal population than 85 percent of the rest of the world.

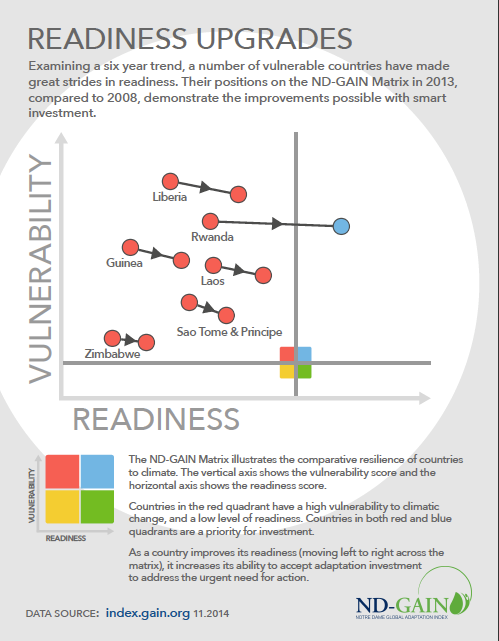

November's deadly typhoon that leveled Tacloban, the Philippines, is likely to be repeated as coastal storms grow in populated areas in these low-lying coastal zones. Some ASEAN countries are less vulnerable and more prepared than others to adapt to these changes.

ND-GAIN, the world's leading index of country-level climate adaptation, ranks nine of the 10 ASEAN countries (Brunei Darsulum doesn't share enough data to be included in the Index.) From Singapore, at 30th on the Index to Myanmar at 163rd, major variations exist in both vulnerability and readiness to adapt throughout the region. The ND-GAIN data indicates that all of the countries are trending up or are stable. Each could set clear priorities for improvement, including:

1. Improving the quality of trade and transport infrastructure.*

2. Establishing good early-warning systems.

3. Adopting building codes that reflect tropical cyclone threats.

4. Implementing insurance mechanism and financing facilities that recognize these threats.

5. Protecting natural capital such as wetlands along the Gulf Coast, sand dunes around New York City and coastal mangrove swamps in Thailand to cushion coasts from storm surges.

6. Increasing the percentage of paved roads.

7. Establishing redundancies in communication infrastructure.

8. Engaging with stakeholders from other sectors and determining who is active in protecting people, natural resources and infrastructure? Being proactive in seeking allies with similar assets at stake who also want to assist, and offering to engage with them.

This year, nature will make its increasingly destructive annual pass around the globe with its litany of tragic tropical cyclones, monsoons, forest fires and the like. However, each offers valuable lessons that we must recognize and learn from -- for our sake and that of future generations. A great deal is at stake.

Some cities and countries will face economic decline as corporations and others shift their valuable supply chains away from weather-threatened regions. Very simply, climate change rates among the key challenges that developing countries must recognize and respond to in planning for their futures.

*Note: According to the Trade and Transport Infrastructure: Logistics professionals' perception of country's quality of trade- and transport-related infrastructure (e.g., ports, railroads, roads, information technology), from the World Bank's World Development Indicators.

(This blog originally appeared on Huffington Post: http://www.huffingtonpost.com/joyce-coffee/another-season-of-climate_b_5419755.html)