There are some incredibly positive sustainability trends baring themselves out today:

There are some incredibly positive sustainability trends baring themselves out today:

- Sustainability is becoming more a part of the ethos of the c-suite

- Non-profit and public/private partnerships are growing in impact

- Sustainable growth is being fueled by innovation in business/technology

Yet these hopeful trends are paired with a more sobering theme: climate risk

This year, 4 out of top 10 global risks derived from World Economic Forum’s global risk perception survey, http://www.weforum.org/reports/global-risks-2014-report, relate to climate disruption

3.Water Crisis

5. Failure of Climate Change Mitigation and Adaptation

6. Greater Incidence of Extreme Weather Events

8.Food Crisis

These risks share space with other risks such as high unemployment, fiscal crisis and political and social instability.

More specifically, one statistic from CDP’s supply chain survey, https://www.cdp.net/CDPResults/CDP-Supply-Chain-Report-2012.pdf, really caught my attention: more than 70% of corporate respondents saw risks to their supply chain from climate disruption.

And indeed, these risks are baring themselves out. 2011’s unprecedented flooding in Thailand alone resulted in $20B economic losses, Honda’s losses totaled more than $250 million when flood waters inundated an auto assembly plant, and - to take another climate impact - General Motors calculated that a one-month disruption at one of its production facilities in Mexico hard hit by drought, could result in a loss of $27 million in net income.

But, as with any business risk, known risk can spell opportunity. Vulnerable sectors crucial to human health and prosperity that also can be greatly improved by innovation – such as food, energy, and water – are prime for investments that help us adapt to climate risks.

The US Military calls climate change a threat multiplier and instability accelerant, and some suggest that climate change fueled conflicts in Chad, Darfur, Yemen and Syria.

And it is not just civil conflict: A report from the World Bank, http://climatechange.worldbank.org/sites/default/files/Turn_Down_the_Heat_Executive_Summary_English.pdf, says that many important development advances of the 20th Century, such as food security, global health and poverty reduction, may be undermined by climate change.

Recently, the Notre Dame Global Adaptation Index produced an analysis that showed it will take more than 100 years for lower income countries to reach the resilience of OECD or richer countries.

While I am concerned for all of us that unprecedented climatic variations are making the world more vulnerable, I reflect on the positive business trends and am certain we can apply our innovation, leadership, and partnerships, to building resiliency.

In fact, there are countless examples of corporate-lead climate adaptation around the world that are helping to decrease the impacts of droughts, superstorms, fires and floods caused by climate disruption.

Leading companies are leaning in, showing the importance of adaptation for their value chains by applying themselves to those vulnerable sectors crucial to human health and prosperity.

Increasing resiliency in food:

- Monsanto is developing new drought-tolerant corn varieties through the Water Efficient Maize for Africa, project, in partnership with the African Agricultural Technology Foundation the Bill and Melinda Gates Foundation, the Howard G. Buffett Foundation and the U.S. Agency for International Development.

- The global reinsurance firm Swiss Re is helping farmers in Ethiopia tackle current and future precipitation uncertainty, providing insurance against climate-related losses.

- PepsiCo is rolling out its i-crop precision-farming technology, enabling farmers to monitor, manage and reduce their water use while maximizing potential yield, in collaboration with the Columbia Water Center of the Earth Institute at Columbia University.

Increasing resiliency in infrastructure:

- Engineering firms such as AECOM and CH2MHill are integrating adaptation into coastal and energy infrastructure systems to protect future generations living in urban areas.

- Ushahidi, a small nonprofit software company, uses the power of crowdsourcing software to distribute real-time information including about roadways and transportation, during disasters in lower income countries and around the world.

Increasing resiliency in water

- Unilever, in partnership with the UN Global Compact and the World Food Program, is spearheading local water use reduction, freeing-up water previously used for clothes washing for other applications in India.

- Ecolab is creating water efficient technologies for commercial and industrial infrastructure that are more resistant and resilient to climate change.

But how do we join these proactive companies on finding market value in resiliency?

As companies are starting to realize that their bottom line is intimately connected with climate disruption, the private sector wants to know where do we get relevant information to inform our leadership?

There are many valuable tools out there.

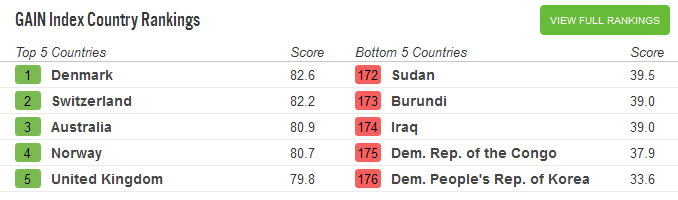

The ND-Global Adaptation Index, http://index.gain.org, ranks the 193 UN countries annually based on how vulnerable they are to droughts, super-storms and other natural disasters and, uniquely, how ready they are to successfully implement adaptation solutions.

We measure the countries’ vulnerability of health, food, water, and infrastructure and the social, governance and economic readiness of the country to take on investment, thus informing many elements of our value chain.

Using 17 years of data, we examine over 50 indicators for each country in the index, and some real winners emerge from these hundreds of thousands of data.

It’s no surprise, European and North American countries are among those most prepared for climate risk.

And many developing countries are making the most and the fastest improvements – as companies invest in these growing markets.

The BRIC countries are doing better than the global resiliency average. And there are some surprises, like Rwanda, which has moved up the rankings 40 positions, primarily by improving its economic, governance and social readiness measures, making it a more viable investment opportunity.

Many companies may find the greatest business opportunities in more vulnerable countries with a high demand for adaptation products and services, but also high readiness based on a transparent, safe and fair investment and regulatory environment.

We can use the ND-GAIN matrix to examine countries in our supply chains, consumer markets, capital assets and community engagements to better understand our relative risks and opportunities.

I’ve found that one of the reasons climate adaptation is resonating with the private sector is that it is a very personal issue. The indicator of climate adaptation success is not an ethereal Metric Ton of CO2e. Adaptation is about direct impacts to our most important assets - our employees, our customers and our communities and their prosperity yesterday, today and tomorrow.

We have the opportunity to save lives and improve livelihoods for millions around the world while improving our market positions by matching the power of data, with corporate innovation, leadership and partnership.

Adaptation provides collateral benefits to

- Mitigate greenhouse gas emissions

- lift more out of poverty,

- strengthen economies,

- prevent civil conflict,

- buttress food security,

- protect natural resources and

- ensure a brighter future for generations to come.

I encourage you to ask yourself the climate adaptation question of your work to create business opportunities out of resiliency that offer rewards for humanity.

(This is the One Great Idea presentation I gave at the Greenbiz Forum today).

Joyce Coffee, Notre Dame Global Adaptation Index Managing Director, opens last year’s ND-GAIN Annual Meeting.

Joyce Coffee, Notre Dame Global Adaptation Index Managing Director, opens last year’s ND-GAIN Annual Meeting.

There are some incredibly positive sustainability trends baring themselves out today:

There are some incredibly positive sustainability trends baring themselves out today: An article caught my attention last week from the

An article caught my attention last week from the  h gained important business-continuity planning lessons from 9/11 and more recent disasters for example, Goldman Sachs’ stellar disaster-recovery preparations that enabled it to keep its lights and power on in lower Manhattan after Hurricane Sandy). I presumed that automakers were also familiar with risk mitigation, drawing lessons from disruptions to their supply chain after Japan’s devastating 2011 earthquake, tsunami and nuclear disaster.

h gained important business-continuity planning lessons from 9/11 and more recent disasters for example, Goldman Sachs’ stellar disaster-recovery preparations that enabled it to keep its lights and power on in lower Manhattan after Hurricane Sandy). I presumed that automakers were also familiar with risk mitigation, drawing lessons from disruptions to their supply chain after Japan’s devastating 2011 earthquake, tsunami and nuclear disaster.