Summer is a great time to reflect on my field. Here are five resilience trends that repeatedly enter my client work.

1. Leaders’ sustainability concerns grow, especially about water

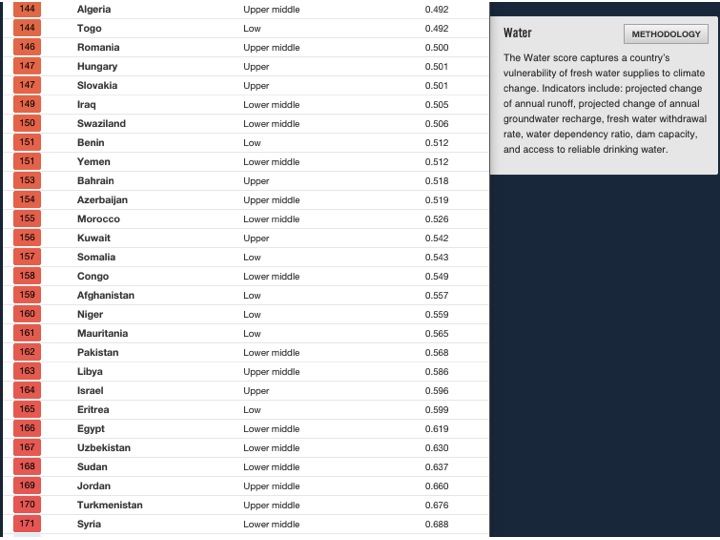

Based on a survey of over 1,000 “educated elites,” this year’s World Economic Forum Global Risks Report[i] ranks extreme weather events, water crises , major natural disasters and the failure of climate change mitigation and adaptation among the top global risks in terms of impact – surpassed only by weapons of mass destruction.

In the United States, floods[ii] are a growing risk in coastal and river-related environments as are communities supported by combined sewers. Local and state governments depend on the U.S. National Flood Insurance Program to help constituents with risk transfer.[iii] But that program is $23 billion in debt and must be reauthorized by Sept. 30.

Related local, county and state government concerns over water issues are reflected in recent resilience initiatives such as:

· National League of Cities: Resilient Water Management: Strengthening Communities & Growing Economies

· International City/County Managers Association: Managing Disasters at the County Level: A Focus on Flooding

· ICMA: County Water Systems: A focus on Developing Resilient Infrastructure

· National Association of Counties: Naturally Resilient Communities online guide toolkit

Further, water and wastewater utilities foreseeing droughts as well as growing extreme precipitation and coastal storms near their capital assets, increasingly focus on resilience. These include activities that complement traditional infrastructure such as “green infrastructure” that uses landscaped areas to absorb and reuse water. For example, the Water Environment Federation[iv], and the American Water Works Association[v] possess resilience platforms for their utility manager members.

At the same time, governments are aware of their crumbling water infrastructure. In its biannual report card, the American Society of Civil Engineers gives a grade of D for water infrastructure and D+ for wastewater infrastructure.[vi] It should be noted that every dollar spent on resilience saves at least four dollars in future losses, estimates the Multihazard Mitigation Council.[vii]

2. Cities see resilience as a competitive advantage

Increasingly, cities embrace resilience. The U.S.-based Star Communities, which evaluates and certifies sustainable communities, and the Urban Sustainability Directors Network of 100-plus city sustainability leaders say no other issue commands as much attention as resilience. Also, two dozen of the 100 cities in the 100 Resilient Cities program pioneered by the Rockefeller Foundation are emphasizing resilience.

Why? Cities explain that resilience helps them to compete to attract more jobs and to be recognized as thriving, vibrant, and desirable places to live and do business.[viii]Politically, the ability to rebound quickly and successfully from shocks and stresses proves essential for a city to remain competitive, investable, and livable. Some cities, such as Milwaukee,[ix] promote their resilience as key levers for economic development and investment.

Indeed, municipal credit rating agencies are beginning to look at resilience-related risks in considering their ratings. For instance, they consider downgrades for communities at particular risk from rising sea levels, such as Norfolk, Va.[x] The agencies also are including climate adaptation in their suggested evaluations of green bonds.[xi]

Even the U.S. government’s withdrawal this spring from the climate change mitigation and adaptation-related “Paris Accord” allowed dozens of cities to publicly affirm their commitment to resilience goals.[xii]

3. Evidence grows of increasing U.S. natural disasters, environmental stressors

Over the past five years, Americans experienced at least 10 major disasters per year, each generating more than $1 billion in damages. That’s a doubling over the average number of such events from 1980-2016.[xiii] Global sea level since the early 1990s is rising at least at double the rates experienced in the previous century.[xiv] And the online real estate data firm Zillow calculates that 1.9 million U.S. homes are at risk (valued at $883 billion) from a six-foot rise in sea level.[xv]

Evidence of climate-driven changes is emerging across the U.S., including:

· Nuisance flooding during high and King Tides in Norfolk, Va.

· Intense storms such as Hurricanes Sandy and Katrina, worsened by warmer oceans and higher sea levels that created havoc in the Gulf and East coasts.

· Prolonged droughts and unusual seasonal patterns disrupting biological processes and agricultural production in the Midwest and California; and thousands of Americans suffering the effects of extreme heat, extended allergy seasons etc.[xvi]

Underscoring these trends, local predictive risk data increasingly is available from both consultants and government sources such as the National Climate Assessment[xvii], which includes downscaled projections and high-resolution spatial climate data.

4. Financing for resilience is an emerging investor category

Resilience has emerged as an investor category of interest in the U.S., even beyond impact investing for giant asset managers such as Blackrock[xviii] and investment advisors such as Mercer.[xix] Likely growth sectors are water, agriculture, healthcare, energy, coastal areas and financial services.

As for government-specific investment options, they include:

· Water efficiency products, desalination, reuse.

· Drought-resistant seeds, drip irrigation, resilient food storage and organization.

· Vaccines, resilient medical facilities for extreme weather events, worker cooling.

· Combined heat and power, distributed generation.

· Microgrids, backup power, energy storage.

· Early warning systems, advanced weather modeling.

Select governments, primarily local, are investigating how to gain additional funding and financing for resilience projects, while also considering the integration of resilience into all of their investor decision-making. They are investigating risk assessment and insurance tools to help inform the market in their region as well as investor tools, such as green and catastrophe bonds. The District of Columbia’s green river project[xx] is a well-known resilience bond issue that received strong demand from investors.

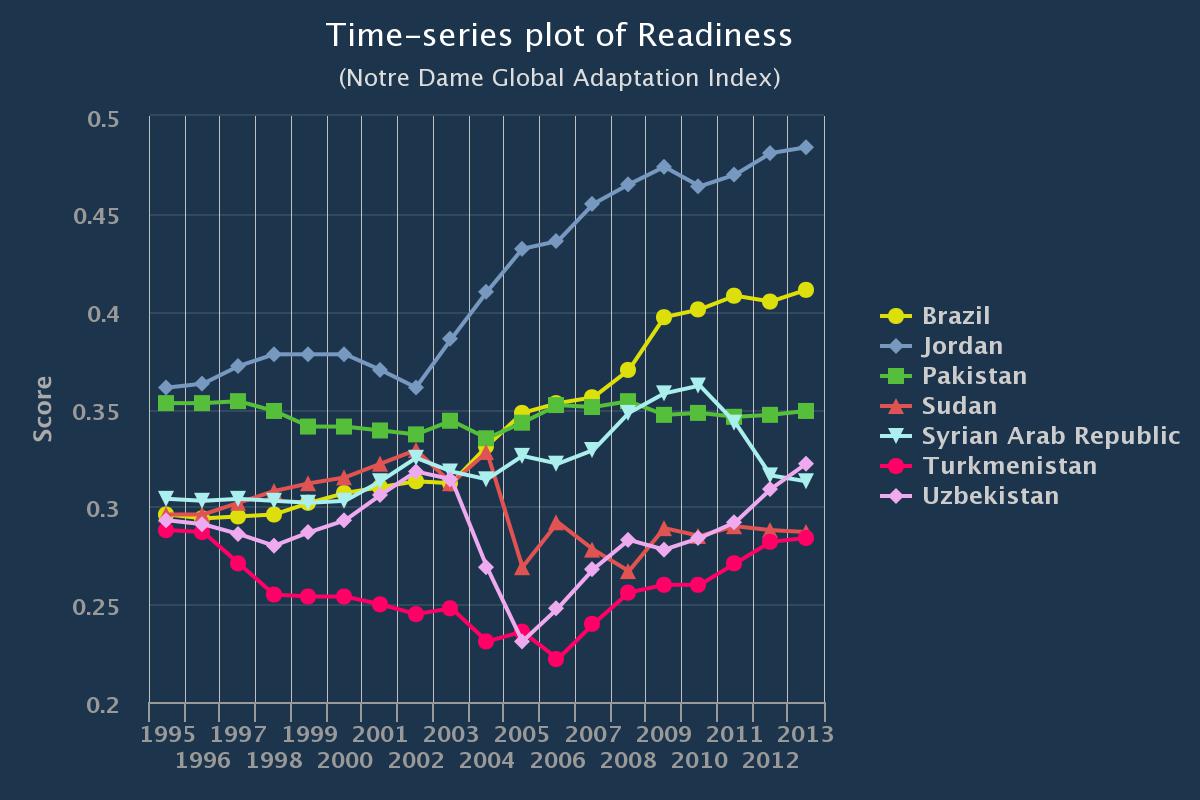

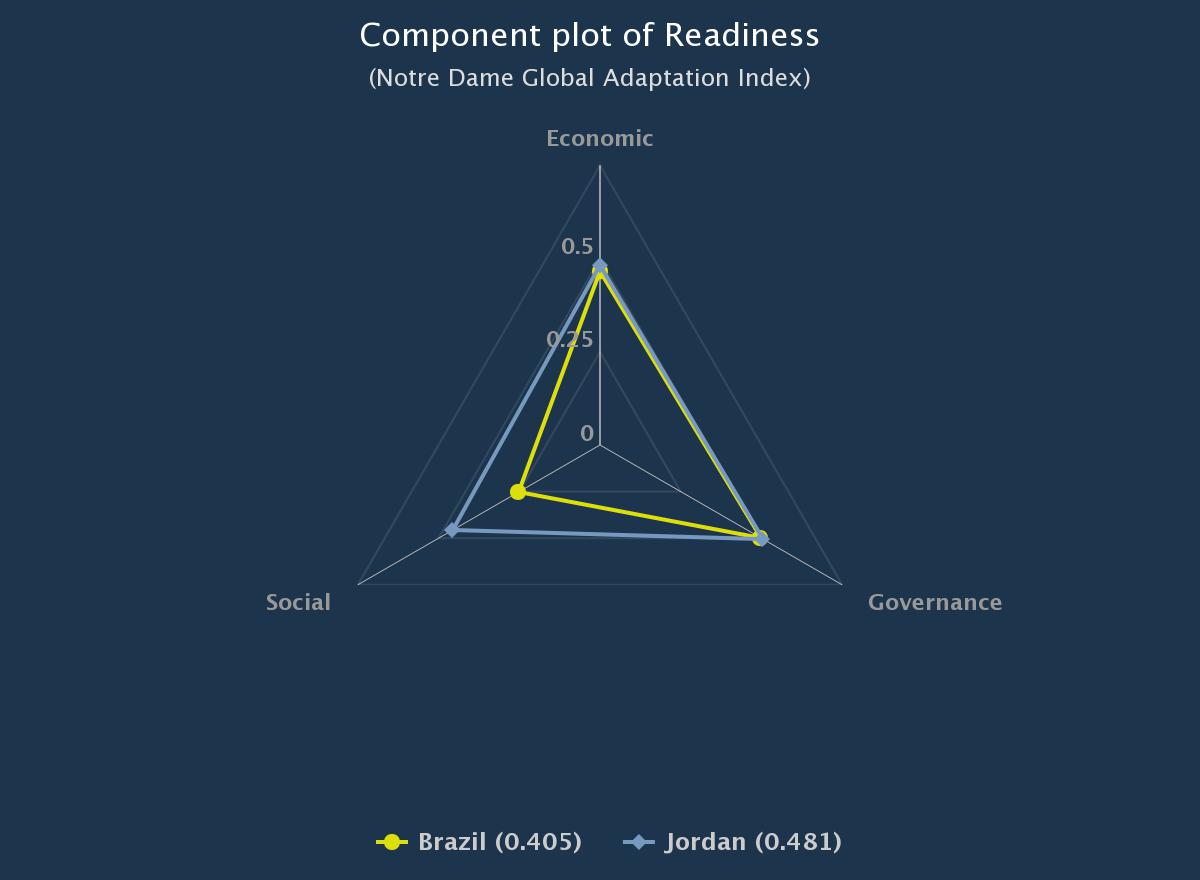

5. Resilience goes beyond the environment: governance, policy, operations are key

At the core of most resilience work isn’t an environmental practice but strong governance and policy arrangements, from water management to urban planning. Significant focus rests with the intersectionality that resilience invites. Resilience’s comprehensive nature demands integrating multiple sectors, stakeholder needs, points of view, objectives and contexts within a system. This creates both tradeoffs and collateral benefits in planning, policymaking and project application. Since resilience is progressing from concept and planning to execution in some parts of the U.S., emphasis grows on developing well-functioning governments and forward-thinking policy to support resilience application.[xxi]

What resilience trends are you seeing in your work?

[i] http://reports.weforum.org/global-risks-2017/

[ii] https://www.ncdc.noaa.gov/billions/events/US/1980-2017

[iii] https://www.washingtonpost.com/national/health-science/the-countrys-flood-insurance-program-is-sinking-rescuing-it-wont-be-easy/2017/07/16/dd766c44-6291-11e7-84a1-a26b75ad39fe_story.html?utm_term=.de2c06d018b3

[iv] http://ngicp.org/

[v] https://www.awwa.org/publications/journal-awwa/abstract/articleid/25801.aspx

[vi] https://www.infrastructurereportcard.org/

[vii] http://www.preventionweb.net/files/1087_Part1final.pdf

[viii] 2016 and 2017 Independent work for the 100 Resilient Cities project as well as for the Kresge Foundation’s Climate Adaptation Field Review.

[ix] https://thewatercouncil.com/why-milwaukee/

[x] http://www.dailypress.com/news/dp-nws-credit-rating-sea-rise-20150515-story.html

[xi] S&P Global Ratings Direct Updated Proposal for a Green Bond Evaluation https://drive.google.com/file/d/0B8AvxaPgEVgdeTVCXzBLYjBRTTQ/view

[xii] http://www.100resilientcities.org/blog/entry/cities-affirm-their-commitment-to-goals-of-the-paris-climate-accords#/-_/

[xiii] See the tracking of global and US insured losses from natural hazard events by the Insurance Information Institute at: http://www.iii.org/fact-statistic/catastrophes-us. For the US, NOAA currently tracks the number of extreme climatic events and their losses; see: https://www.ncdc.noaa.gov/billions/.

[xiv] Griggs, G., Arvai, J., Cayan, D., DeConto, R., Fox, J., Fricker, H.A., Kopp, R.E., Tebaldi, C., Whiteman, E.A. 2017. Rising Seas in California: An Update on Sea-Level Rise Science. Oakland, CA: California Ocean Science Trust.

[xv] https://www.zillow.com/blog/rising-sea-levels-coastal-homes-202268/

[xvi] See the Third US National Climate Assessment for the most recent comprehensive assessment of these types of impacts: http://nca2014.globalchange.gov/. The Fourth Assessment is currently underway.

[xvii] https://www.data.gov/climate/portals/

[xviii] https://www.blackrock.com/investing/literature/whitepaper/bii-climate-change-2016-us.pdf

[xix] https://www.mercer.com/our-thinking/investing-in-a-time-of-climate-change.html

[xx] https://www.dcwater.com/green-bonds

[xxi] https://www.odi.org/sites/odi.org.uk/files/resource-documents/10626.pdf